The AI Industrial Transformation: Why This Bubble Has Real Revenue (Unlike the Dot-Com Fantasy)

While everyone’s fighting over Bay Area “AI engineers” at $500K, we’ve tripled revenue with zero layoffs over the past four years.

Our approach? We stopped chasing the hype and built something that actually works.

Our system: 1 ML engineer for every one full-stack engineer. All full-stacks know Python well enough to handle ML bottlenecks. The ML engineer owns model architecture, training optimization, and hyperparameter tuning. Full-stacks handle everything else: data pipelines, API scaling, production monitoring, performance optimization.

This 1:1 ratio outperforms teams with 5-10 “AI engineers” every single time.

The results speak: 95%+ retention. Zero layoffs. Revenue 3x. 12-month voluntary attrition: <5%. Average tenure: 3.1 years.

How we avoided the $500K hiring war: Our engineers are in Ukraine and Europe. Boston-based company, 100% remote since before the COVID-19 pandemic. Engineers outside Silicon Valley are often better. Bay Area market dynamics do not spoil them. They solve problems instead of chasing titles.

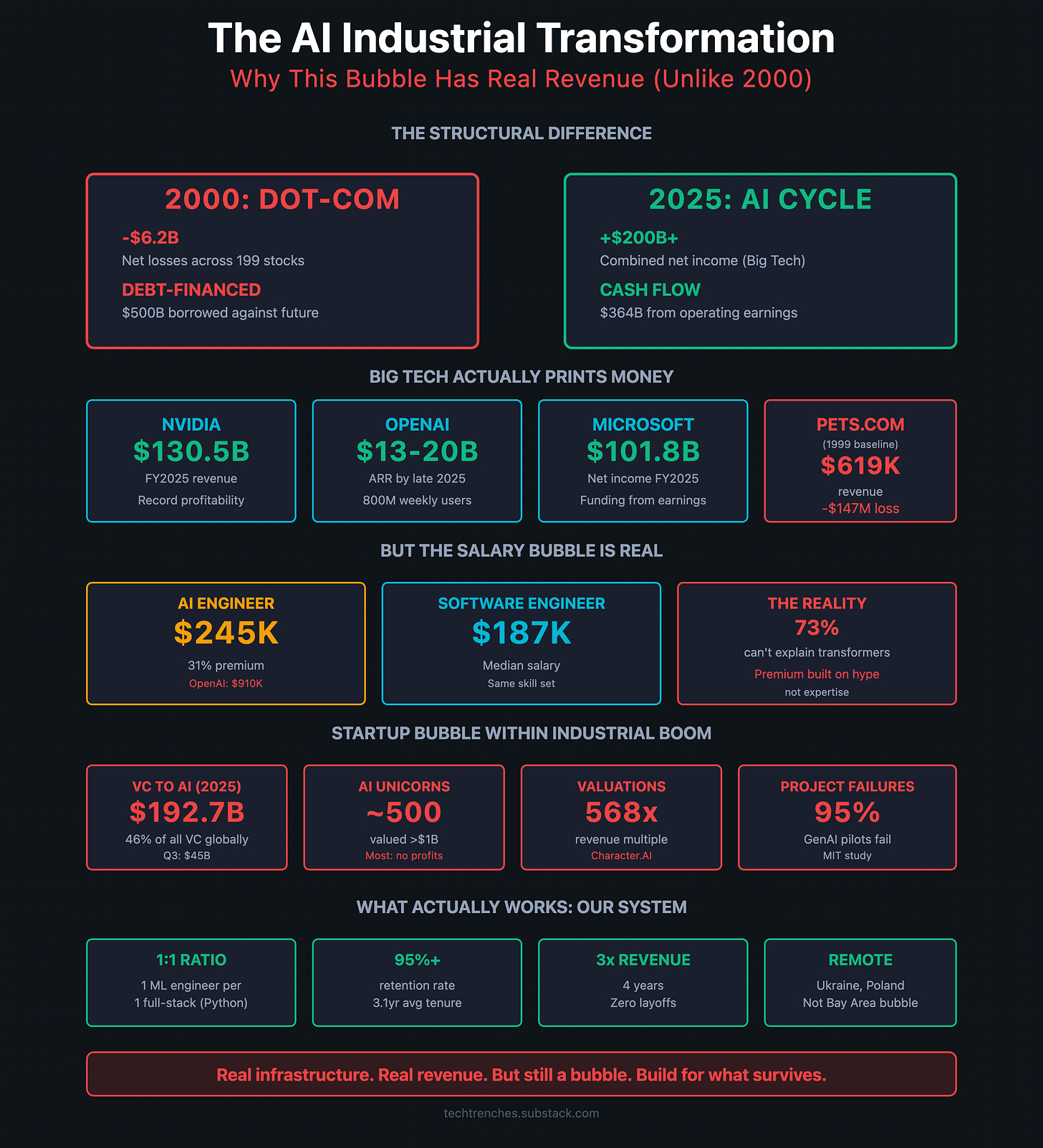

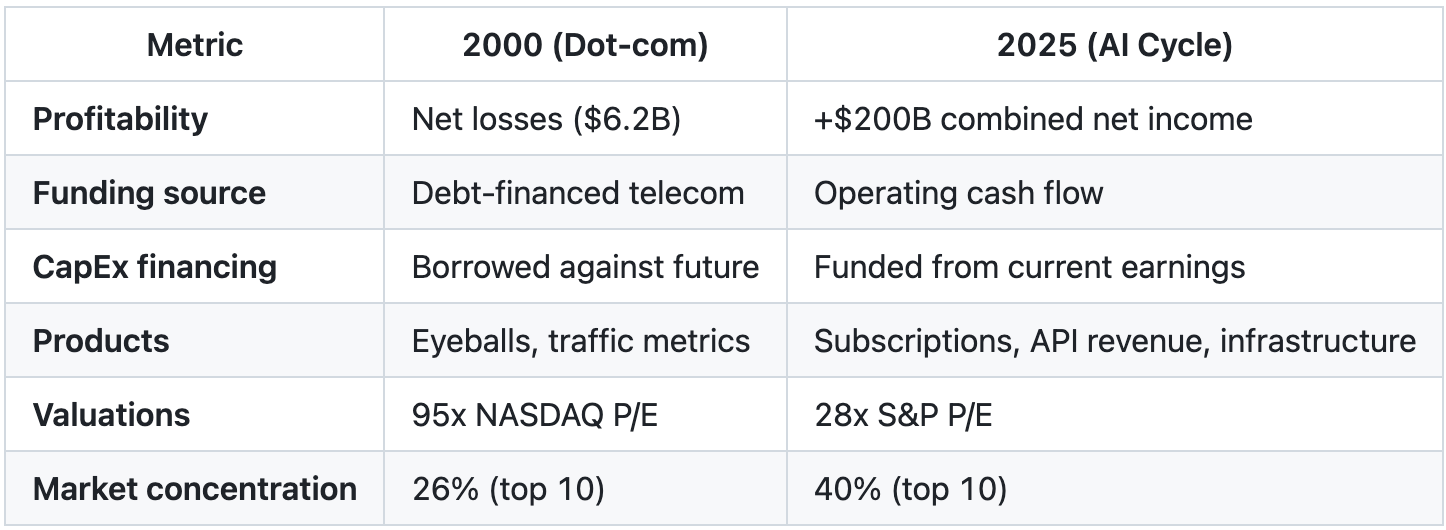

While everyone panics about AI destroying jobs and tech bubbles popping, here’s what’s actually happening on the ground. And why is this transformation fundamentally different from 2000?

The Revenue Is Real This Time

NVIDIA has become the first company to surpass a market capitalization of $5 trillion. That’s larger than Germany’s entire GDP. One chipmaker is now worth more than the world’s fourth-largest economy.

Everyone’s screaming “bubble.” I get it. The concentration is unprecedented. But here’s what they’re missing: these companies actually make money.

NVIDIA reported $130.5B in FY2025 revenue and record profitability. Datacenter demand is sold out for quarters ahead. OpenAI is projected to reach $13-20 billion in annualized revenue by late 2025, with 800 million weekly active users. Microsoft’s AI business surpassed $75 billion annually in Azure cloud revenue (up 34% YoY).

Compare that to 2000. The 199 internet stocks tracked by Morgan Stanley collectively lost $6.2 billion on $21 billion in sales. 74% reported negative cash flows. Companies worth billions, losing millions, selling dreams.

Pets.com in 1999? $619,000 in revenue and $147 million in losses. Business model: sell dog food below cost to gain “market share.”

OpenAI in 2025? $13-20B ARR from 5 million paying business customers. $20/month consumer subscriptions. $30/user/month enterprise deals. Billions in API usage fees.

The dot-com bubble sold promises. This bubble is building infrastructure with real cash flow.

Even Federal Reserve Chair Jerome Powell said it explicitly: “These companies actually have earnings. They actually have business models and profits and that kind of thing. So it’s really a different thing.”

This is why everyone’s investing in AI talent. When companies print billions in profit, they pay whatever it takes, which brings us to the uncomfortable truth about what they’re actually buying.

Most “AI Engineers” Are Overpriced Python Developers

AI engineers earn a median salary of $245,000, compared to $187,200 for software engineers, a 31% premium. At OpenAI, it’s $ 910,000, while at Meta, it's $560,000. But here’s the uncomfortable truth: when 73% can’t explain how transformers work, that premium is built on hype.

Watch the shift by level: entry-level premiums dropped from 10.7% to 6.2%, while staff+ rose from 15.8% to 18.7%. The premium is concentrated at senior levels. Entry-level AI engineers are becoming commoditized, just like full-stack engineers were before the COVID-19 pandemic.

The market will correct. It always does.

This is exactly why our system works.

We built this system deliberately. ML engineers excel at building models, training, and optimization. However, they struggle with fundamental engineering and architectural problems. Scaling APIs. Debugging production issues. Building resilient pipelines.

The first ML hire was great at the ML work. But every infrastructure problem became a bottleneck. Features sat waiting for architectural decisions. Production issues took days to debug.

That’s when we formalized the approach: pairing each ML engineer with full-stack engineers who have expertise in Python. The ML engineer owns the model work. Full stacks handle the engineering fundamentals.

On every project, we have a lead engineer who acts as the architect. They make the structural decisions. The ML engineer focuses on what they’re actually good at. Full stacks execute on solid architecture.

This isn’t about replacing ML engineers. It’s about letting them focus on the 20% that requires deep ML expertise instead of struggling with the 80% that’s basic engineering.

But the salary bubble is just a symptom. The real story is where all this money is actually going.

$364 Billion in Infrastructure: Funded by Profits, Not Debt

The four major cloud providers are spending $315-364 billion in 2025 alone. Every dollar is funded from the operating cash flow of profitable operations.

This is the structural difference from 2000. Telecom companies deployed $500 billion in debt-financed infrastructure in the late 1990s. 85-95% of the capacity became “dark fiber” that remained unused. The companies collapsed under the debt they couldn’t service.

Today’s spending is backed by companies like Microsoft, which generated $101.8 billion in net income in fiscal 2025. They’re spending from earnings, not borrowing against future promises.

I covered this in detail in Big Tech’s $364 Billion Bet on an Uncertain Future. Key takeaway: this is real infrastructure backed by real profits.

So where does all this infrastructure spending lead? To a fundamental reshaping of who has jobs and who doesn’t.

What’s Actually Happening to Jobs

Between 80,000 and 132,000 tech employees lost their jobs in 2025 through November. But here’s the pattern most people miss: AI eliminates jobs at certain skill levels while amplifying expertise at others.

Salesforce cut 4,000 customer support roles (9,000 to 5,000). CEO Marc Benioff: “I need fewer heads.” Result: 17% cost reduction, AI agents handling 1M+ conversations.

Klarna reduced workforce 40%. An AI assistant is performing the work of 700 customer service employees. Query resolution: 11 minutes to 2 minutes. Revenue per employee: $400K to $700K annually.

IBM cut hundreds of HR jobs, replaced by the “AskHR” AI chatbot. Handles 94% of routine HR tasks.

Skills becoming obsolete include manual data entry, basic coding without a thorough understanding, routine customer queries, simple content writing, basic graphic design, and repetitive administrative tasks.

If your job is primarily execution with minimal judgment, you’re in the blast radius.

This is why our 1:1 ratio works: we’re amplifying engineers, not replacing them. When AI automates the routine stuff, engineers who can handle complex problems become more valuable. Not less.

But there’s a paradox nobody’s talking about.

The AI Productivity Paradox: Why That $500K Premium Doesn’t Scale

Companies are paying 31% premiums for “AI engineers.” But here’s what the data actually shows: individual developers report being 20% faster with AI tools, while measured organizational productivity drops 19%.

I covered this in detail in The State of AI in Engineering: Q3 2025. The pattern is consistent across multiple studies: individual speed increases, while organizational throughput remains flat or declines. The code is “getting bigger and buggier.” Junior defect rates are 4x higher. Seniors spend their productivity gains verifying AI output instead of shipping features.

The economic implication? Companies are paying bubble premiums for a productivity gain that doesn’t materialize at the organization level. They’re betting $500K salaries will solve scaling problems when the actual bottleneck is architectural oversight and code review. AI amplifies expertise; it doesn’t replace it.

But here’s the problem this creates: if companies only want seniors who can supervise AI, where do those seniors come from?

The Pipeline Is Breaking

New grad hiring is down 25% from 2023 to 2024. Entry-level software engineering jobs are being eliminated at a faster rate than any other category.

Companies only want seniors who can supervise AI. However, you can’t hire a senior engineer who was never a junior engineer.

In five years, we’ll face a shortage of experienced engineers because we have stopped training juniors today.

This is the quiet systemic risk nobody’s talking about. Everyone’s optimizing for the next quarter. Nobody’s thinking about who builds the next generation of engineering leaders.

As I wrote in AI Won’t Save Us From the Talent Crisis We Created, the industry’s obsession with senior-only hiring has created a pipeline problem that will only worsen.

Companies that invest in developing talent, not just buying it, will have the advantage when the correction comes.

While this pipeline problem builds quietly in Big Tech, the startup world is showing classic bubble characteristics.

The Startup Bubble Within the Industrial Boom

Big Tech prints money. Record profits back their infrastructure spending. But the startup ecosystem? That’s where the bubble math stops working.

Venture capital to AI in 2025:

Q3 alone: $45 billion (46% of all VC globally)

Total through September: $192.7 billion

For the first time, AI captured over 50% of all venture capital

By various estimates, ~500 AI “unicorns” emerged in 2025, valued at over $1 billion. Most have no profits.

Valuations that don’t make sense:

Character.AI: 568x revenue multiple

Inflection AI: $4B valuation, then essentially shut down

AI wrapper startups: billion-dollar valuations for thin layers over OpenAI API

The math gets absurd. By various estimates, $560 billion has been invested in AI infrastructure (2023-2025) while AI-specific revenue reaches ~$35 billion. That’s a 16:1 investment-to-revenue ratio. Infrastructure spend has outpaced monetization by an order of magnitude.

The project failure rates tell the real story:

Gartner: 30% of GenAI projects abandoned after proof of concept

MIT: 95% of GenAI pilots fail to achieve rapid revenue acceleration

S&P Global: 42% of companies scrapped most AI initiatives in 2025

McKinsey: 80% of companies report no tangible EBIT impact

Yet Microsoft Copilot customers report a 68% boost in job satisfaction alongside productivity gains.

The difference? Implementation sophistication, not just adoption.

Companies that succeed:

Purchase AI from specialized vendors (67% success) vs internal builds (33%)

Use grassroots adoption (70% success) vs top-down IT mandates (20%)

Fundamentally redesign workflows (90% success vs 20% without)

So is this 2000 all over again? Not quite. But it isn’t very easy.

Why This Isn’t 2000 (But Correction Risk Is Real)

The dot-com crash didn’t kill the internet. It killed companies that confused narrative for value. This AI transformation won’t crash the same way.

Here’s the structural difference:

But legitimate risks remain:

Startup valuations at 568x revenue multiples

Circular financing (NVIDIA invests in OpenAI, which buys NVIDIA chips)

Infrastructure buildout ahead of demand monetization

95% pilot failure rates

Market concentration creating systemic risk (NVIDIA is 7.65% of the S&P 500)

The critical question isn’t whether AI will transform the economy (it obviously will). The question is whether current startup valuations and infrastructure investments can be justified by the near-term returns they generate.

Goldman Sachs argues that the spending is justified, estimating a potential value of $8-19 trillion to the US economy. AI investment remains below 1% of GDP, compared to 2-5% in prior technology cycles.

Both things are true:

This is a genuine industrial transformation with real revenue

Specific market segments show bubble characteristics

Unlike 2000, even if corrections occur, the infrastructure is built by companies that can absorb losses while maintaining profitability in core businesses. The technology works. The profitable companies keep operating. The real transformation continues.

This is why our geographic arbitrage strategy works even better now.

Why Remote-First Beats the Bay Area Hiring War

The Bay Area talent war has created an artificial scarcity problem. When everyone competes for the same 50,000 engineers within a 50-mile radius, salaries become disconnected from the value delivered. $500K for junior “AI engineers” who can’t debug Python? That’s not a market, that’s a bubble.

The alternative isn’t cheaper engineers. It’s better talent pools.

We’ve been 100% remote since before the COVID-19 pandemic. Our engineers are based in Ukraine, Poland, Romania, and increasingly, talented US engineers outside the Bay Area who’d rather work remotely than relocate for inflated compensation tied to the inflated cost of living.

Remote-first changes the math:

Access to engineers who prioritize craft over job titles

Teams that stay: 95%+ retention, 3.1 year average tenure, <5% voluntary attrition

Engineers solving problems instead of optimizing for the next job hop

Sustainable burn rates that survive market corrections

This isn’t about replacing anyone. It’s about escaping artificial constraints. When you compete for talent in the same 50-mile radius as everyone else, you’re bidding against bubble prices for access to the same talent pool.

When the market corrects (and specific segments do), companies built on $ 500,000 salary structures will scramble. Companies that develop sustainable teams with global talent pools will continue to succeed.

Remote-first since before COVID means we had a four-year head start on distributed team operations. That advantage compounds during a crisis, whether it’s a pandemic, a market correction, or a talent shortage.

So what should engineering leaders actually do?

What Engineering Leaders Should Do

I’m not here to predict the future. But here’s what the data shows works:

1. Hire for Fundamentals Over Hype

Can they debug a memory leak? Build a distributed system? Do they know Python well enough to fix ML bottlenecks?

Actual engineering skills matter more than AI certificates.

When the premium collapses (and it will), you want engineers who can still ship.

2. Build Hybrid Teams That Actually Work

One ML engineer paired with a Python-fluent full-stack beats ten “AI engineers” every time.

The ML engineer owns the 20% that requires deep expertise. Full stacks handle the 80% that’s engineering fundamentals. This scales. This ship.

3. Expand Beyond the Bay Area Bubble

The Bay Area hiring war is an example of an artificial scarcity problem. When everyone competes in the same 50-mile radius, you’re bidding against bubble prices for the same talent pool.

Build remote-first. Look at talented engineers in Ukraine, Poland, Romania, US cities outside SF, anywhere with a strong engineering culture but without Bay Area salary inflation. You’ll find engineers who prioritize building great products over optimizing their next job hop.

The constraint isn’t talent availability. It’s geographic self-limitation.

4. Keep Burn Rates Sane

When everyone else pays $500K for junior AI engineers, you’re building sustainable teams. When the correction comes, you’re still operating.

5. Redesign Workflows, Don’t Bolt Tools

AI is effective when integrated into existing workflows by individuals who understand both the domain and the technology.

It fails when treated as a magic replacement for expertise.

Most companies bolt AI onto existing processes. You need to rethink how work gets done fundamentally. That’s where the 90% success rate comes from.

6. Invest in the Junior Pipeline

Someone has to train the next generation of seniors. If everyone only hires experienced engineers, where do those engineers come from?

The companies that develop talent, not just buy it, will dominate when the correction comes.

The World Has Changed. Build for What Survives.

AI is not a magic wand. It’s a powerful tool that amplifies expertise in capable hands.

Companies that treat it as a replacement for thinking will fail. Companies that use it to multiply the effectiveness of experienced professionals will dominate.

Yes, this is a bubble. But it’s fundamentally different from 2000. The infrastructure is real, backed by operating profits, not debt. The revenue exists. The products work. When corrections happen, the technology doesn’t disappear; unprofitable companies do.

It is an industrial bubble. One where infrastructure is being built faster than monetization can scale. Where startup valuations exceed any reasonable near-term revenue projections, where 95% of pilots fail, but billions keep flowing.

The difference from 2000? When this is corrected, the infrastructure remains. The technology works. The profitable companies keep operating. The real transformation continues.

Good engineers will always be in demand. The ones who can actually build, debug, and ship. The ones who solve problems instead of chasing titles.

Most companies are optimizing for short-term hype instead of long-term systems. They’re buying “AI engineers” at absurd premiums instead of building teams that can actually deliver.

When the correction comes (and it will come), the companies still standing will be the ones that built for substance, not spectacle.

The question isn’t whether you’re building for the correction. The question is whether you’re creating something that survives it.

What patterns are you seeing in your organization? Are you building for sustainable transformation or hoping the music doesn’t stop?

First of all, I love your style, attitude, and usually opinions. This time, however, I seem to be strongly in disagreement, especially in your comparison. The Dot Com bubble burned a lot of cash, yes, and the AI bubble is doing exactly the same. You are comparing apples to oranges, here, putting on the same line _net_ losses to a combined income which counts the same thing twice or more. Considering NVidia as an AI company is like saying that who sells bricks is in the construction business. It isn't, it's merely profiting from it. OpenAI is burning so much venture capital money that it's hard to track, but still you report it as a profitable company. I really don't know how this post came to be, but I'm confused. Still, I could totally be wrong about this: your posts are always interesting, and intellectual challenges like this post are the occasion to grow.