When Announcements Replace Innovation: OpenAI’s Code Red and What It Reveals About the AI Industry

When Announcements Replace Innovation: OpenAI’s Code Red and What It Reveals About the AI Industry

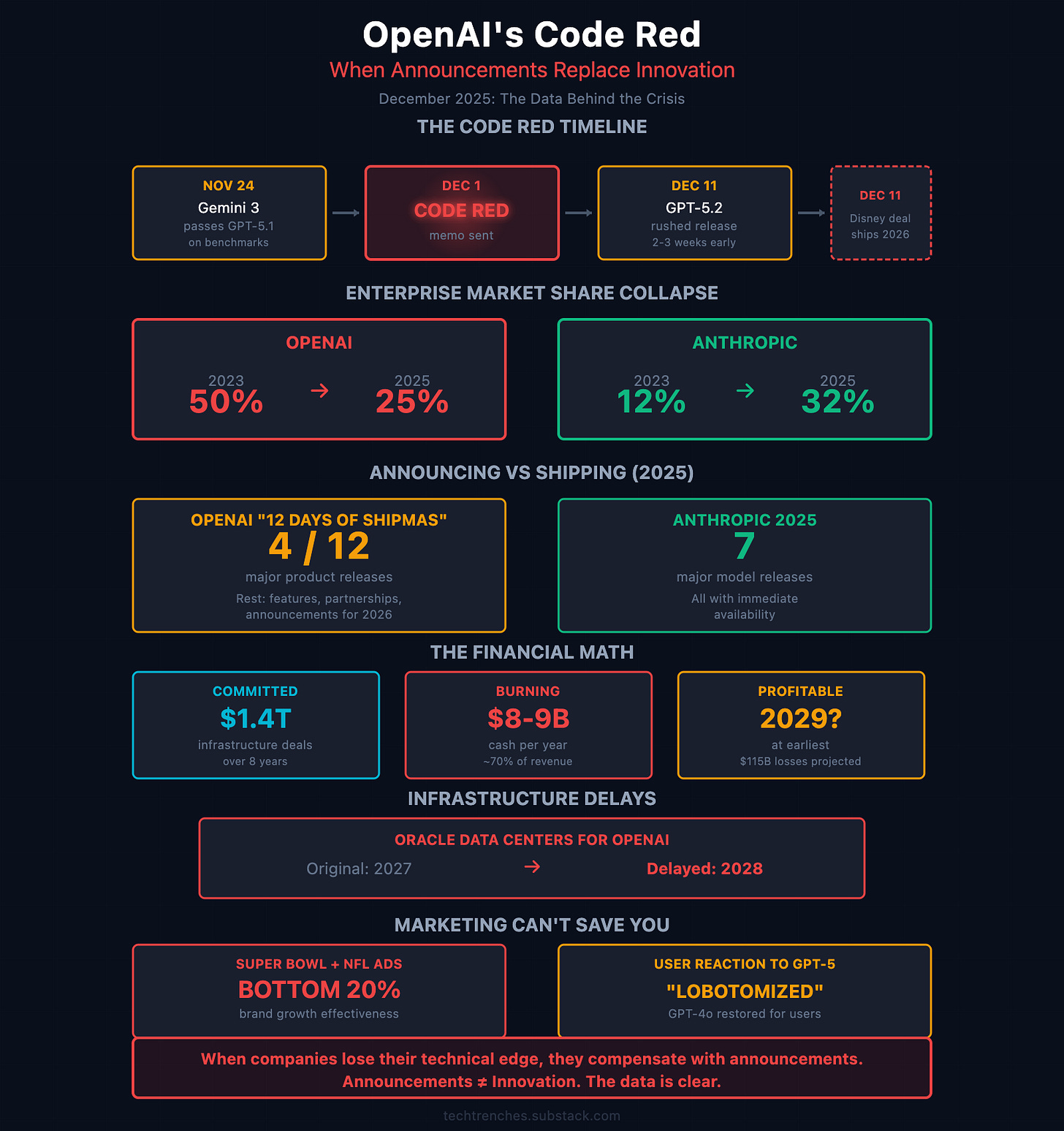

December 1st, 2025. Sam Altman sends an internal memo declaring “code red” at OpenAI. According to The Wall Street Journal and The Information, the trigger was specific: Google’s Gemini 3 had just passed GPT-5.1 on key benchmarks. Altman privately told employees Gemini 3 “could create economic headwinds for OpenAI.”

The company that defined modern AI is now playing catch-up.

Nine days later, they rush GPT-5.2 out the door. Two to three weeks ahead of schedule. The day before launch, Altman posts a cryptic cooking video hinting at the release. Marketing theater while engineering scrambles.

I’ve been watching OpenAI’s 2025 closely. The pattern is unmistakable: more announcements, less substance. More partnerships, fewer shipped products. More hype, weaker market position.

The uncomfortable truth: OpenAI is becoming a marketing company that happens to do AI research. And the numbers prove it.

The 12 Days of Shipmas Set the Tone

December 2024. OpenAI announces “12 Days of Shipmas.” Daily livestreams. Sam Altman hosting. “Some big ones and some stocking stuffers.”

Of 12 announcement days, only 4 delivered major product releases.

Day 1: o1 full launch + ChatGPT Pro ($200/month tier). Day 3: Sora video model. Day 9: o1 API for developers. Day 12: o3 model preview—announced, not shipped.

The rest? Feature expansions. Accessibility additions. Partnership announcements. A phone hotline. WhatsApp integration.

MIT Technology Review nailed it: “The arms race is on. And while the 12 days of shipmas may seem jolly, internally I bet it feels a lot more like Santa’s workshop on December 23.”

InfoQ summed up the community reaction: “Great product launches by OpenAI but few model updates. Lots of models from Google, few product updates.”

Announcements ≠ shipping. OpenAI chose the first. Competitors chose the second.

GPT-5 Launched. Users Revolted.

August 7, 2025. GPT-5 arrives. Altman calls it “a legitimate PhD expert in any area.” The numbers look good: 700 million weekly users, 18 billion messages weekly, 4x year-over-year growth.

Then users actually try it.

Within days, thousands of complaints flood Reddit and social media. “Flat.” “Uncreative.” “Lobotomized.” “Like an overworked secretary.” One viral post: “GPT-5 sounds like it’s being forced to hold a conversation at gunpoint.”

Altman’s response to The Verge: “We totally screwed up.”

Six days later, a more measured admission on X: “We for sure underestimated how much some of the things that people like in GPT-4o matter to them, even if GPT-5 performs better in most ways.”

They restored GPT-4o access for Plus users within 24 hours of launch. Think about that. Users prefer the old model. The “upgrade” was a downgrade in experience.

What followed was reactive scrambling:

August 7: GPT-5 launch

November 24: GPT-5.1 release (focused on “warmer, more conversational personality”)

December 11: GPT-5.2 emergency release (fast-tracked after Gemini 3)

Three major versions in four months. Not innovation. Damage control.

The Financial Reality

Here’s where it gets complicated. OpenAI has committed to approximately $1.4 trillion in infrastructure deals through 2033 (per HSBC analysis).

$300 billion with Oracle (5 years). $11.9 billion with CoreWeave (5 years). $30 billion per year for data center capacity. The Stargate project targeting $500 billion total.

Against those commitments: $8-9 billion cash burn in 2025. About 70% of revenue. The company spends $1.69 for every dollar it generates.

The trajectory gets steeper before it improves. Fortune reported that by 2028, operating losses will balloon to roughly three-quarters of revenue. Cumulative losses through 2029: $115 billion, according to The Information.

HSBC’s assessment: OpenAI still won’t be profitable by 2030 and faces a $207 billion funding shortfall.

For comparison: Anthropic projects break-even in 2028, with cash burn dropping to 9% of revenue by 2027. OpenAI burns 14x more cash than Anthropic before turning profitable.

December 12th: Bloomberg reports Oracle has pushed back several OpenAI data center projects from 2027 to 2028. Labor and material shortages.

You can’t download more electricity. You can’t manufacture data centers faster than physics allows. And the financial math requires everything to go perfectly for a decade.

The Disney Deal Says Everything

Same day as GPT-5.2—December 11th—OpenAI announces a partnership with Disney. $1 billion investment. 200+ characters licensed across Marvel, Pixar, Star Wars, Disney classics. Integration with Sora video generation.

Sounds massive. Look closer.

Products won’t launch until 2026. The deal is still “subject to negotiation of definitive agreements.” The Writers Guild of America criticized it as appearing “to sanction” OpenAI’s “theft of our work.”

This is the pattern. Big announcement. Future delivery. Immediate headlines. Delayed substance.

Meanwhile, Google shipped 100 things at I/O 2025. Twenty-five to thirty available immediately. Not announced. Available.

AI Mode for all U.S. Search users. Imagen 4 and Veo 3 in Gemini app. NotebookLM mobile apps. Gemini Code Assist generally available. Jules coding agent in public beta.

One company announces. One company ships.

The Market Share Collapse

The real data is brutal.

OpenAI enterprise market share: 50% → 25% over two years.

Anthropic enterprise market share: 12% → 32% over the same period.

For enterprise coding specifically, Anthropic commands 42% versus OpenAI’s 21%. Double.

Salesforce CEO Marc Benioff publicly announced he was “ditching ChatGPT” for Gemini 3. His words: “The leap is insane. Everything is sharper and faster.”

When your flagship enterprise customers are making public statements about switching to competitors, the marketing can’t save you.

What Anthropic Did Differently

Anthropic delivered seven major model releases in 2025. Each with immediate availability:

February 24: Claude 3.7 Sonnet

May 22: Claude Opus 4 + Sonnet 4

August 5: Claude Opus 4.1

September 29: Claude Sonnet 4.5

October 15: Claude Haiku 4.5

November 24: Claude Opus 4.5

No “12 Days of Shipmas.” No cryptic cooking videos. No emergency releases after competitive pressure.

Claude Code went from research preview (February) to general availability (May) to $1 billion run-rate revenue by November. Ten months.

Anthropic’s valuation trajectory: $61.5 billion (March) → $183 billion (September) → $350 billion (November). The market rewards shipping.

The Marketing Campaign Failure

OpenAI’s response to competitive pressure? More marketing.

February 2025: First Super Bowl ad. September 2025: Larger brand campaign during NFL Primetime. The CMO called the fall campaign “a bigger spend than Super Bowl ad.”

System1 consumer research found both major ads ranked in the lowest 20% for long-term brand growth and immediate sales impact. Consumers couldn’t identify the brand until the final seconds.

The irony, as marketing commentator Mark Ritson noted: “After years of sneering at traditional media, proclaiming the death of television...what does OpenAI do when the chips are down? It buys TV ads.”

Ads can’t fix product gaps. Marketing can’t replace engineering. Announcements can’t substitute for shipping.

The Talent Exodus Accelerates

Here’s what I watch most closely: who’s leaving—and who’s staying.

SignalFire’s 2025 State of Talent Report tells the story in numbers:

OpenAI retention rate: 67%

Anthropic retention rate: 80%

DeepMind retention rate: 78%

Engineers at OpenAI are 8x more likely to leave for Anthropic than the reverse. At DeepMind, that ratio is 11:1 in Anthropic’s favor.

The departures keep coming. September 2024: Three senior executives leave in one day—CTO Mira Murati (6.5 years), Chief Research Officer Bob McGrew, VP of Research Barret Zoph.

Mira Murati’s next move: she quietly built a 60-person team for her startup Thinking Machines, pulling 20 staffers from OpenAI before even announcing the venture.

Meta’s summer 2025 recruiting spree triggered internal panic. Chief Research Officer Mark Chen sent a memo comparing the exodus to “a home invasion.” He told employees leadership was working “around the clock” to retain top talent.

Jan Leike, who co-led OpenAI’s Superalignment team, joined Anthropic and criticized his former employer for prioritizing “shiny products” over AI safety. John Schulman, co-founder who led reinforcement training, followed him to Anthropic. Lucas Beyer, who led OpenAI’s Zurich office, left for Meta.

When your research leaders leave to join competitors citing philosophical differences, the announcements won’t bring them back.

The Uncomfortable Questions

After watching this pattern for a year, some questions I keep asking:

When did shipping become secondary to announcing?

Why does Disney get headlines when products won’t ship for a year?

What happens when a $207 billion funding shortfall meets infrastructure delays?

How long can marketing cover for product gaps?

The code red memo answered one question. OpenAI knows the lead has evaporated. Whether they can do anything about it remains unclear.

The Bottom Line

OpenAI entered December 2025 in reactive mode. Responding to competitive threats with rushed releases and high-profile partnerships. Enterprise market share halved. Users preferring old models. A $207 billion hole to fill before profitability.

Google shipped three major model generations while investing $91-93 billion from profitable operations.

Anthropic delivered seven major releases with immediate availability, capturing enterprise leadership through product quality rather than marketing volume. Their talent retention is 13 percentage points higher than OpenAI’s.

The pattern I keep seeing across tech: when companies lose their technical edge, they compensate with announcements. When they can’t ship faster, they promise bigger. When the product struggles, the marketing budget grows.

OpenAI is becoming the clearest case study of this pattern.

The question isn’t whether they declared code red. It’s whether code red means shipping better products or announcing louder partnerships.

Right now, the data suggests the second.

What patterns are you seeing in the AI companies you work with? When does the announcement-to-shipping ratio signal real trouble?

P.S. If you want the full timeline of OpenAI’s 2025 announcements vs. actual releases, reply to this email. The contrast is instructive.

P.P.S. This analysis is based on 13 years of building at NineTwoThree. 150+ projects for Consumer Reports, Experian, SimpliSafe, FanDuel. We’ve learned the hard way that shipping beats announcing—every time.